The annual payments then escalate at a 5% rate. Because payments are made in advance, the first payment of $1,000 is made in period 0.

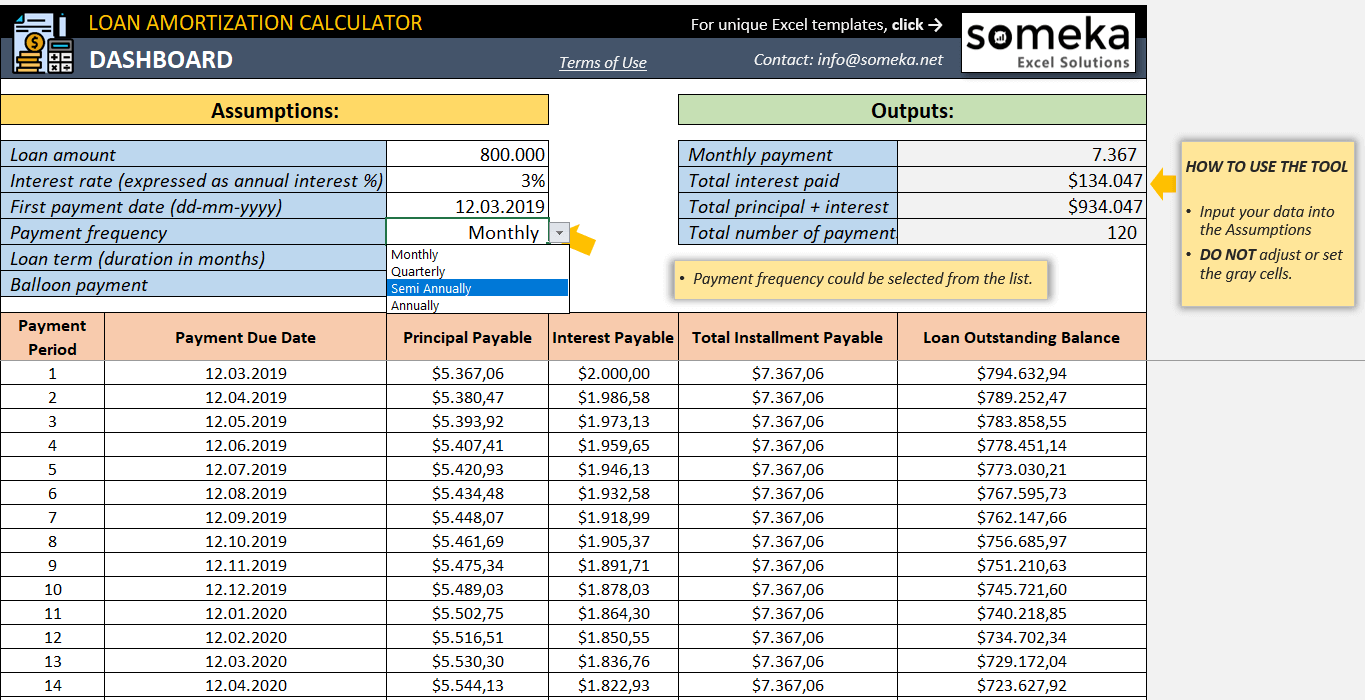

Step 2: Enter the number of periods and cash paymentsĮnter the number of periods corresponding to the lease term starting from 0, and enter the cash payments in each period. Step 1: Create an Excel spreadsheet with these five columnsĬreate a new Excel spreadsheet and title five columns with the following headers: Period, Cash, Expense, Liability Reduction, and Liability Balance, as shown below: Assume the rate inherent in the lease is 6%. How to create the lease amortization schedule and calculate your lease liabilityĭownload our free present value calculator to follow along:įollow the steps below to calculate the present value of lease payments and the lease liability amortization schedule using Excel when the payment amounts are not constant, illustrated with an example:Ĭalculate the present value of lease payments for a 10-year lease with annual payments of $1,000 with 5% escalations annually, paid in advance.

This is calculated as the initial step in accounting for a lease under ASC 842, and this amount is then used to calculate the ROU (right-of-use) asset, that is recorded in addition to the liability for operating leases and capital leases.Ī lessee’s obligation to make the lease payments arising from a lease, measured on a discounted basis. The lease liability is defined as the present value of your future lease payments. Transitioning to ASC 842, IFRS 16, and GASB 87 can be difficult, but there are resources that can help you gain an understanding of the methods laid out below for our calculations. You can use the information in this blog to ensure that your chosen software provider is performing this calculation accurately. Private companies in particular may be tempted to try to use an Excel spreadsheet for lease accounting, but this information is important even if you plan to use lease accounting software for compliance with the new standard. In this article, we will demonstrate how to calculate the present value of your lease payments as well as prepare the liability amortization schedule for the lease liability in the same step, using Excel. Previously, we covered how to calculate the present value of lease payments using Excel spreadsheets.

0 kommentar(er)

0 kommentar(er)